How to Deal with Missing Invoices in GSTR-2B? Get Practical GST Course in Delhi, 110084, by SLA Consultants India, New Delhi,

Jun 6th, 2025 at 06:27 Learning Delhi 4 views Reference: 7Location: Delhi

Price: Contact us Negotiable

How to Deal with Missing Invoices in GSTR-2B

Missing invoices in GSTR-2B can disrupt your Input Tax Credit (ITC) claims and lead to compliance issues. Addressing these gaps promptly is essential for smooth GST operations and avoiding disputes or penalties. Here’s a step-by-step guide to managing missing invoices in GSTR-2B, tailored for professionals and learners in Delhi, 110084, and those considering practical GST training with SLA Consultants India.

1. Identify Missing Invoices Through Reconciliation

Download GSTR-2B: Access the GST portal after the 14th of each month and download your GSTR-2B for the relevant period.

Compare with Purchase Register: Use Excel or GST software to match invoices in your purchase register with those reflected in GSTR-2B. Focus on supplier GSTIN, invoice number, date, and value.

Highlight Discrepancies: Use tools like VLOOKUP/XLOOKUP and conditional formatting to quickly spot invoices present in your records but missing in GSTR-2B.

2. Common Causes of Missing Invoices

Supplier Non-Compliance: Supplier has not uploaded the invoice in their GSTR-1 for the period.

Wrong GSTIN or Invoice Data: Supplier entered incorrect details, causing mismatches.

Timing Differences: Supplier reported the invoice in a different period.

Unaccounted Debit/Credit Notes: These may also be missing if not uploaded by the supplier.

3. Immediate Actions to Take

Contact the Supplier:

Promptly inform the supplier about the missing invoice(s).

Request them to upload or amend the invoice in their next GSTR-1 filing.

Document Communication:

Keep records of all follow-ups and supplier confirmations for audit purposes.

4. Claiming ITC on Missing Invoices

Do Not Claim ITC Immediately:

ITC can only be claimed on invoices reflected in GSTR-2B. If an invoice is missing, defer the ITC claim until it appears in a subsequent GSTR-2B after the supplier uploads it.

Claim in Next Valid Period:

Once the supplier uploads the invoice and it appears in GSTR-2B, claim ITC in that tax period’s GSTR-3B.

5. Prevent Recurrence

Regular Reconciliation:

Reconcile GSTR-2B with your purchase register monthly, ideally just after the 14th when GSTR-2B is generated.

Supplier Management:

Work closely with suppliers who frequently delay or misreport invoices. Consider alternate vendors if non-compliance persis.

6. Audit and Documentation

Maintain Clear Records:

Keep a summary of eligible, ineligible, and pending ITC due to missing invoices for each period.

Prepare for Scrutiny:

Well-documented reconciliations and communications with suppliers help during audits and departmental queries.

Get Practical GST Course in Delhi, 110084, by SLA Consultants India

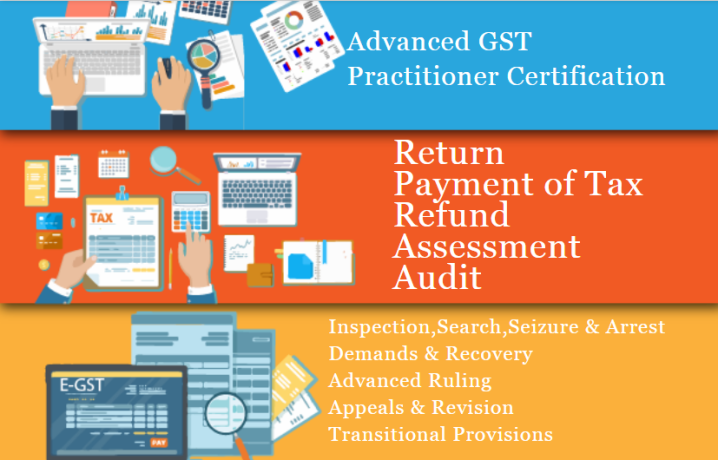

SLA Consultants India offers a practical GST Training in Delhi (serving 110084), focusing on:

GSTR-2B reconciliation and ITC management

Handling missing invoices and compliance best practices

Real-world assignments and GST software training

Expert CA-led sessions

Flexible classroom/online batches

100% job placement support

Summary:

To deal with missing invoices in GSTR-2B, promptly reconcile your records, contact suppliers for corrections, and claim ITC only when invoices appear in GSTR-2B. Regular reconciliation and proactive supplier management are key. SLA Consultants India’s GST course in Delhi equips you with these practical skills for robust GST compliance.

SLA Consultants How to Deal with Missing Invoices in GSTR-2B? Get Practical GST Course in Delhi, 110084, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/